Spring 2024 Update

Over the past few months, our priority has been towards foundational enhancements to TradingLite’s core back-end infrastructure. This focus on future-proofing our platform’s performance and reliability as we scale, ensures we will continue to deliver on our commitment; to provide you industry-leading market analysis tools.

Without any further delay, here are the latest additions, improvements and bug-fixes to TradingLite!

# 10 Gigabit Network Upgrade 🚀

Today's update is running on our first iteration of our new bleeding-edge TradingLite infrastructure. In turn, this will allow us to fine-tune the engine powering our data, prior to a general release.

Initial tests are yielding great results:

# Core Network Upgrade Benefits

Ultimately, the primary benefit of this network upgrade is to allow us to focus on development, by maintaining and creating industry-leading tools.

Whilst the hardware upgrades will net inherent performance gains, ensuring our back-end service can fully utilize these upgrades, is just as important.

Provisionally, these enhancements once finally complete will unlock:

Limit-less exchange/pair capacity

Vastly improved redundancy and subsequently, reliability, including automated-failover)

Enhanced data throughput (initial tests indicate massive improvement)

Ability to scale beyond EU, US and JP server regions

# Opt-in to Battle-Test

We will be rolling out the network upgrade fully once finalized. To speed up this process, we need you, to help battle-test a number of iterative improvements we will be pushing daily.

Those who are seeking to test very latest improvements to our back-end infrastructure, can do so by selecting the EU (NEW) server from the region selector:

The new EU (NEW) server will enable you to experience the latest enhancements. Whilst our intention is maximize the derived benefits from this network upgrade, be aware that there may be teething issues.

# New Features 🚀

Today’s release of TradingLite brings a range of new features, improvements and bug-fixes. Most importantly, all TradingLite users will gain access to these new features!

# New Order Book Profile 🚀

Order book analysis is close to our heart at TradingLite. Our market-leading liquidity heatmap provides both historical and real-time update from within the order book. Rather than providing partial or pre-filtered data, the TradingLite Heatmap provides full, complete, order book snapshots. This then gives you total freedom over whether, and by how much, you chose to both; filter data and refine the heatmap’s intensity.

This flexibility provided by the granular controls you have over the TradingLite heatmap, means that is often used as a primary tool, with more advanced users combining simultaneously along side the Order Book Panel. This allows such users to compare pre-defined liquidity conditions via the heatmap filtering and intensity, with current unfiltered liquidity conditions of the order book. Whilst these comparisons have always been natively achievable, it would be far easier to perform comparisons within a single chart.

Today brings the latest addition analyzing liquidity on TradingLite, the Order Book Profile:

The Order Book Profile tool provides a new method on TradingLite in which to visualize real-time changes in liquidity conditions of the order book. This allows a direct comparison between the order book, and your customized heatmap filtering and intensity.

The width of each row shown within the Order Book Profile tool, represents the cumulative value of limit orders at each price point.

The wider the row within the profile, the greater the value of limit orders are currently waiting to be filled at that price group. Note that when you navigate the chart, each row’s width is calculated proportionally on the fly, to reflect the price range shown on your chart.

Head over to the new dedicated Order Book Profile learn section, for a full breakdown:

# 3 New Official Indicators 🚀

The update brings 3 new Official Indicators to TradingLite. Although the underlying data for these tools has always been accessible via LitScript (and by extension our community’s 450+ created tools & indicators), a long term request from users has been officially sanctioned versions.

# Official Liquidations Layer 🚀

A cascade of liquidations within a short period can signal a possible reversal in price. Exchange-published liquidation data has always been accessible via LitScript. This has led to a huge range of over 40 community created tools available to you on TradingLite, that either use or extrapolate this raw liquidation data stream.

Whilst the edge provided by community created liquidation tools on TradingLite are inherently popular, some users requested an in-house developed tool. Today we are pleased to offer our Official Liquidations Indicator, streaming the same unadulterated exchange-published data available via LitScript, direct to your charts as an official layer.

By default:

The value of long positions liquidated is shown in Green, below a base of zero

The value of short positions liquidated is shown in Red, above a base of zero

Plot as a histogram, these values are updated in real-time as liquidation events occur. The value of respective long and short liquidations within the candle’s life are totalled to provide the final liquidation prints.

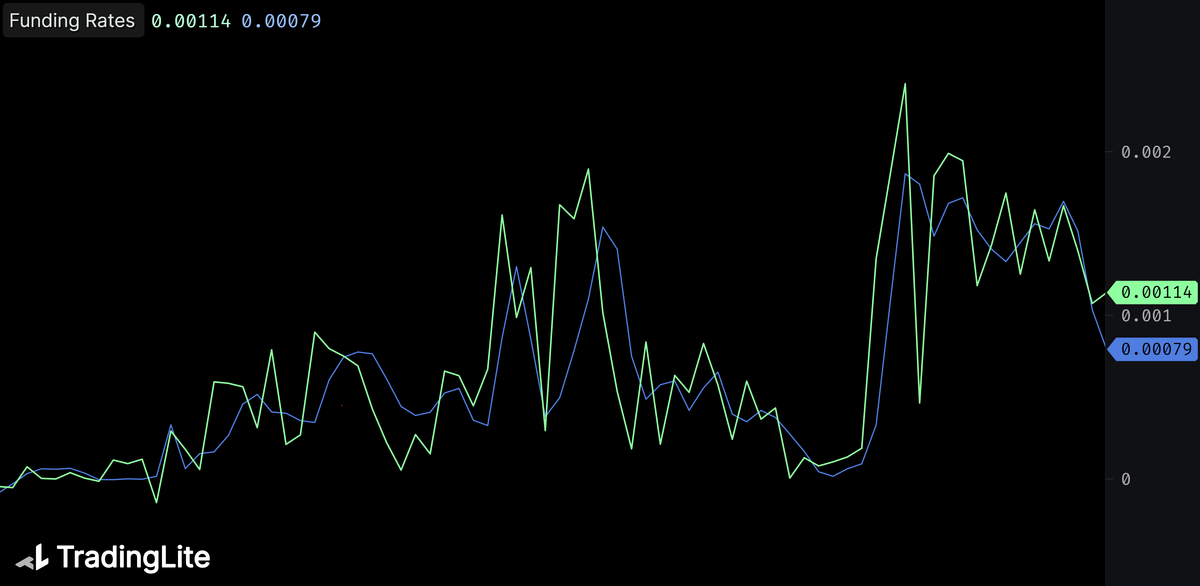

# Official Funding Rates Layer 🚀

All exchanges share the same objective of ensuring a perpetual contract’s price remains as close to a spot index of the underlying. Although they all achieve this via a Funding Rate mechanism, the timing, frequency and ultimately method, in which funding rates are both calculated and then subsequently applied to open positions, can vary between trading venues.

Live, real-time updates to both the current and predicted funding rates for each market again have always been available via community created indicators. Today all users will have direct access to an Official Funding Rates Indicator.

The Official Funding Rates indicator, by default displays both:

The Official Funding Rate indicator can be configured to display either both rates simultaneously, or independently from one another.

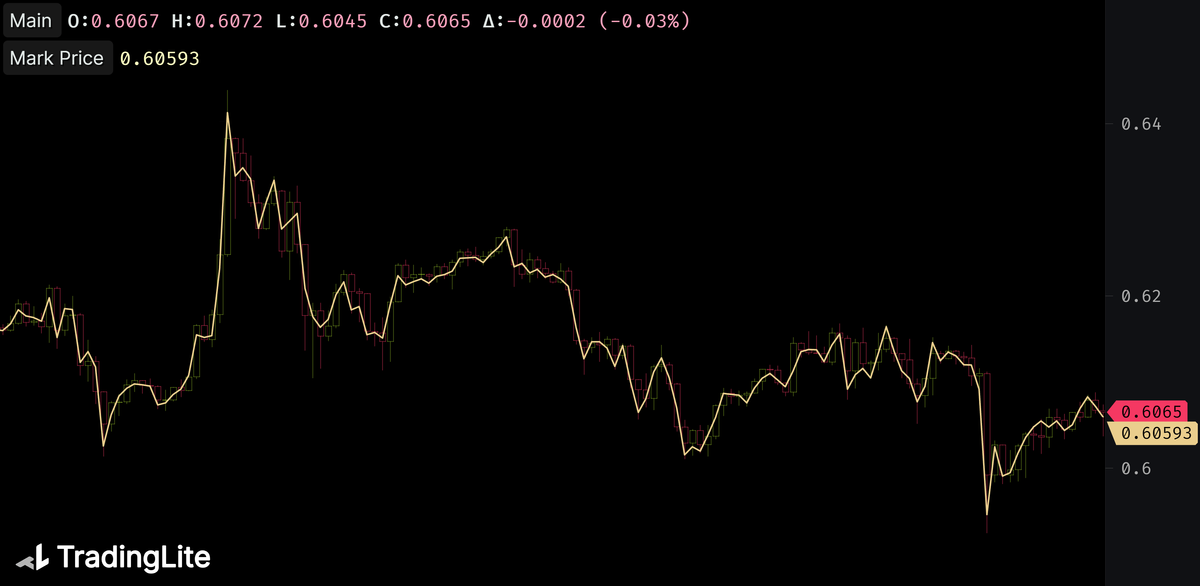

# Official Mark Price Layer 🚀

To prevent forced liquidations en mass during periods of abnormal market conditions (whereby the contract price differs considerably from the underlying spot price), a Mark Price is calculated by the exchange to assign a fair market value of the contract.

From today, a Mark Price line plot overlay will be available on TradingLite.

This Mark Price is the reference price is used to determine a traders’ unrealized profit and loss (in addition to any possible liquidation trigger). Whilst not necessarily a core staple of your chart, having Mark Price available to reference upon volatile moves can be handy.

# Quality of Life Improvements

Today's update also contains a wide range of bug-fixes and improvements to enhance your day-to-day UX. See our changelog (inside the app: TL logo > Changelog) for a complete breakdown of the 100+ changes included in this release.

# New Markets

We will shortly be adding our next batch of markets to TradingLite. Be sure to suggest and vote for your choices within the Market Requests feedback area.

# Join the team...

As TradingLite continues to grow, we are looking to expand our team. If you are interested in creating industry-leading tools used by thousands of traders each day, head over to Careers.