Introduction to Mark Price

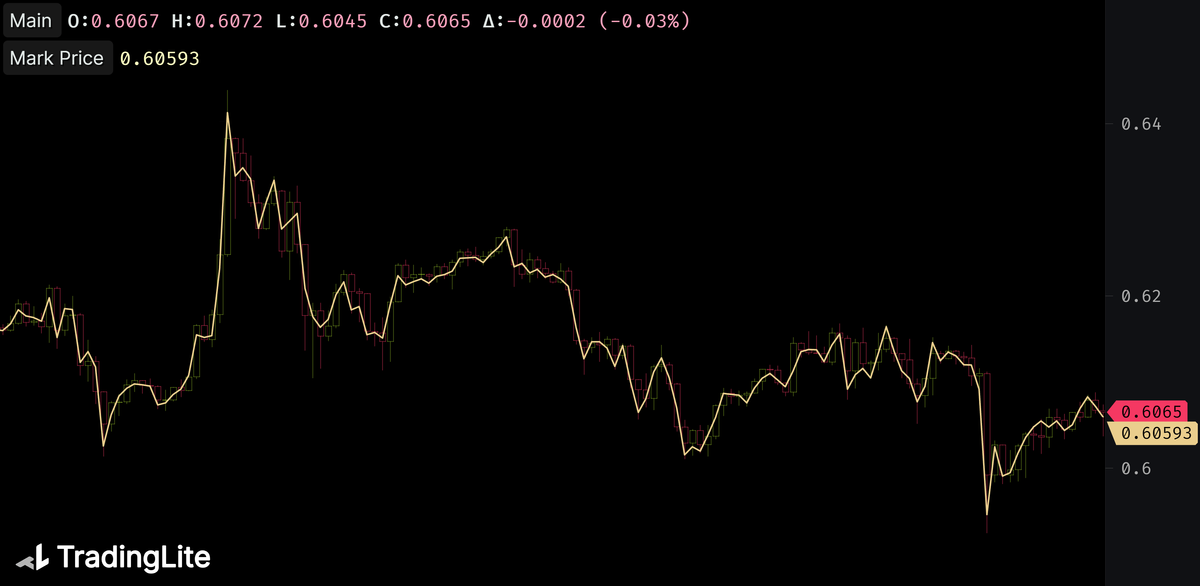

Mark Price is the reference price is used to determine a traders’ unrealized profit and loss (in addition to any possible liquidation trigger).

To prevent forced liquidations en mass during periods of abnormal market conditions (whereby the derivatives contract price differs considerably from the underlying spot price), a Mark Price is calculated by the exchange to assign a fair market value of the contract.

Activating Mark Price Indicator

The official Funding Rates Indicator can be added to your chart by navigating to:

Indicators > Official Indicators > Mark Price

By default, the Mark Price indicator will be overlaid over your Main chart type via a line plot.

Mark Price Settings

Upon activating the Mark Price indicator, you will be able to configure the following styling preferences:

Color

Color & Transparency

Line Thickness

Weight in pixels

Line Mode

Smooth

Stepped

Mark Price Considerations

Spot Markets

Mark Price is only applicable within futures markets.

Mark Price does not exist within spot markets.

Auto-Scale Disabled

The Mark Price layer is not automatically scaled to your chart. By design, this allows easier observation of the spread between the mark and contract price. This ensures the chart does not become skewed In volatile conditions.

Other Futures Indicators

TradingLite provides the full range of derivative data data points available via our Official Indicators. These includes Open Interest, Liquidations & Funding Rates.

Open Interest

Liquidations

Funding Rates

Was this page helpful?