March 2023 Update

Over the past month, the team has been primarily focused on performing some major changes under the hood. However, that's not to say this update doesn't bring some some exciting additions and improvements!

# Layout Templates are Live! 🚀

Back in December, we revealed Layout Templates - the single-click method to switch between your various chart layouts. Initially released as an 'experimental' feature, we are now pleased to announce that this update brings this major addition to your TradingLite UI by default.

We are also pleased to share that users on both Gold and Silver plans will have a total of 10 Layout Template Slots at their disposal!

We have some exciting plans in store for Layout Templates in the near future, so be sure to get your self acquainted with this powerful feature!

# Re-Sizeable Split-View 🚀

TradingLite's Split-View function allows you to view up to 4 charts at the same time. Natively, you are provided a total of 16 presets from which to choose from.

As one of our most used features, some from our community requested the ability to have more control over these splits. From today, you will now be able to resize horizontally and vertically. This flexibility is designed to suit whichever preferences you may have.

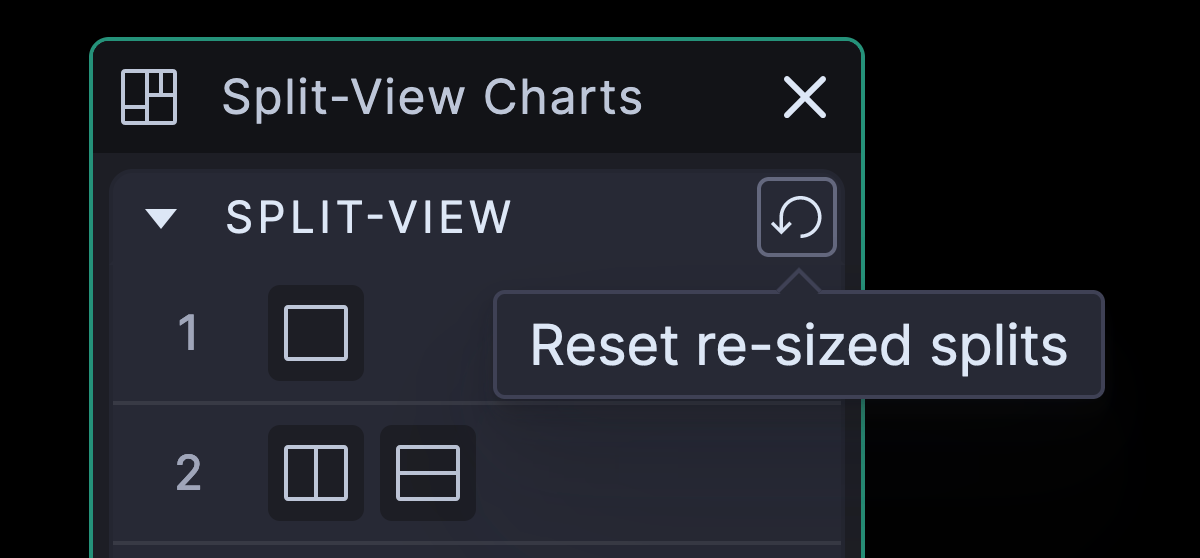

Should you wish to reset your splits to the preset default, simply open the Split-View menu, and click the 'Reset re-seized splits' button.

# Improved Panel Docking 🚀

Following the popularity of our Multi-Order Book & Multi-Trade Feed panels feature when using Split-View, we decided to re-vamp and improve our Panel Docking interface.

You are now able to dock in between multiple panels, allowing you to adjust virtually any window you have open to your preferred position. Previews of positions have also been given visual improvements also.

# Under the Hood Improvements

Whilst sometimes over-looked and not receiving all the attention, glitz and glamour new features or tools are showered in, this update brings numerous performance enhancements and UX/UI improvements.

For the full details, including a few minor bugs that have been fixed, check the changelog when in app.

# Heatmap Block Size Explainer

Given the recent change to Binance's Bitcoin pairs, we thought we'd take this opportunity to give you a little further context surrounding the change.

TradingLite's first ever tool was our beloved Heatmap. However, before we set sail on our initial adventure to create a best in class liquidity & historic order-book analysis tool, we had to envisage how volatile market conditions would have an impact on calculating an appropriate block value. Literally, the very building blocks that make up the heatmap itself.

# Heatmap Algorithm

Striking a razor fine balance between heatmap granularity, whilst maintaining impeccable rendering performance, is no small task. Then for added complexity, apply this to markets where price can rapidly increase by many multiples, just as easily as it can fall 99%.

So... How do we maintain this perilous balance without sacrificing granularity or performance?

Everyone's favourite - a whole bunch of complex math.

# Algorithm Structure

At the start of each month, we assess the pair's previous monthly historic data across a range of data points:

Market Determined Price Volatility Liquidity Conditions

| Exchange Determined Order Book Depth Raw tick size changes

|

Every month, for every pair, our algorithm makes an assessment of the above. Its goal is always to maximise the amount of data available to the end user, whilst ensuring rendering speed will not be impacted.

# Granularity Increase

Similarly as Bybit's Bitcoin pairs experienced a change on February 1, the algorithm adjusted Binance's Bitcoin pairs block size on March 1. This change resulted in a 2x increase in granularity. The HD Heatmap block size for Binance's Bitcoin pairs is now $5, down from an original $10 value.

# Assessment & Review

Shortly after the change a small subsection of users stated that they preferred the previous $10 block size. Equally, on the other hand many were thrilled to have 2x the level of both liquidity and order flow detail (the HD blocksize also determines our order flow granularity). Some users actively seek increased granularity, others prefer the status quo.

As explained in the previous section above, the elements that contribute to the algorithm are determined by a mix of both market participants, and the trading venue itself. However, whilst the inputs are determined by others, we ultimately have control over the output.

After reviewing valid arguments from either side, we've internally formulated a plan of how everyone's preferences can be accommodated for in the future. Work is already underway to both; provide a greater range of block sizes (beyond HD and SD), while also refining the algorithm and its respective output.

Note to self: buy bigger abacus...